The five-part Value Scout Exit Planning framework, otherwise known as the Exit Planning 2.0 framework, puts the value at the heart of the exit planning process and helps advisors solve the central problem most owners face in achieving a successful transition – their business simply isn’t worth enough. Read this article for a high-level overview of the Exit Planning 2.0 Framework, or access this webinar for a summary of all five phases.

The Five Phases of the Exit Planning 2.0 Framework:

- Define and Measure the Problem

- Analyze

- Improve

- Re-assess

- Exit

A Quick Recap of Phase 1 — Define and Measure

In Phase 1 of the Exit Planning 2.0 Framework, we have gone through the business value baselining process. We defined needs and measured wants via a financial needs analysis and goal articulation. Now, for instance, we know that our client has a business worth $10M, and they need to get to $25 Million in enterprise value by year 5 to exit successfully.

Now we have to figure out how to get there. That’s precisely the 2nd step in the Exit Planning 2.0 Framework, Analyzing.

Phase 2 — Analyze. Determine How to Grow Value.

We can set the goal as high as we want. We wish to be a billion-dollar company, but will we get there? We need to be in line with reality. We need to put together the ‘to be model’ of what the company looks like in the future. Then finally, a long-range plan or long-range strategy to connect the dots between the V0 today and the ‘to state’ of the company or the state of exit window is. There are three parts to this:

- Do a Reality Check

- Define the “To Be Company”

- Set the Long Range Strategy

#1 – Do a Reality Check

When we think of a reality check, we think of three things–desirability, feasibility, and viability.

First, let’s start with desirability. How much do we want to drive towards what the stated goal is? Here, the founder’s feelings matter. Suppose a young founder concludes that he does not want to be a $100 million company CEO. And if the goal is to be a $100 million enterprise, it is not desirable to the young founder. So, this scenario fails reality check number one.

For the second reality check–feasibility, we need to ask questions like:

- Can we achieve this goal?

- Is it practical at every level to reach from point A to B?

And then we need to check for viability–the third reality check.

So just because we can do it doesn’t mean we should do it. All sorts of things fall in the path of something being viable but not necessarily desirable. So, we got to get through that reality check piece before going further with a value creation plan.

#2 – Define the “To Be Company”

We need to discuss with the founders and the company’s leadership team what the company will look like five years down the road. Let’s try to understand this with an example.

Suppose, in the goal articulation phase, we decided that we are a $30 million company today, and we’re trying to get to $100 million. We need to ask questions like:

- How different is that going to be?

- How different is the staff going to be?

- How do leadership and management need to evolve?

- How does the footprint need to evolve? Are we all in offices? Is it just one single office, or are we now in six different offices to get there? Is the workforce virtual? What proportion?

Working through what the ‘To Be State’ looks like is always an eye-opening experience. But we have to get there.

Some of this is financial modeling, and some are more exploring some ideas with the leadership team of how we’re going to do this. It’s one thing to say we want to be a $100M company and paint a vision of that company with a broad brushstroke. It’s another thing to paint a detailed picture of what that company will look like. And what the company likely needs to look like to capture new product lines, market share, or whatever is going to get us from here to that next growth plateau.

#3 – Set the Long Range Strategy

We need to come up with a strategy to close the gap between where the company is today and where we are trying to take it in the future – turning it into the ‘To Be Company.”

There are different ways and methods of formulating a strategy, and we can adopt any of them. It doesn’t matter. What matters is getting there and getting to something cohesive that the company can rally around.

Remember that Exit Planning 2.0 is a framework and not a methodology. So, we are not trying to be prescriptive on how you do strategy. We suggest that strategy has to be done, and the company needs to adopt something to get from here to there. While the process you take is probably critical to engaging clients, from a pure value creation standpoint, we’re more interested in getting as transparent as we can on the future state the client is trying to achieve.

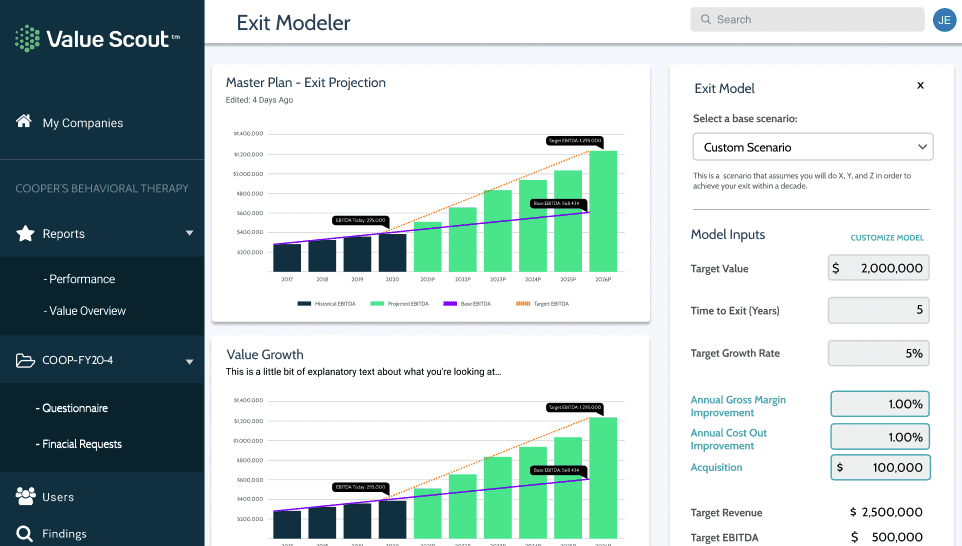

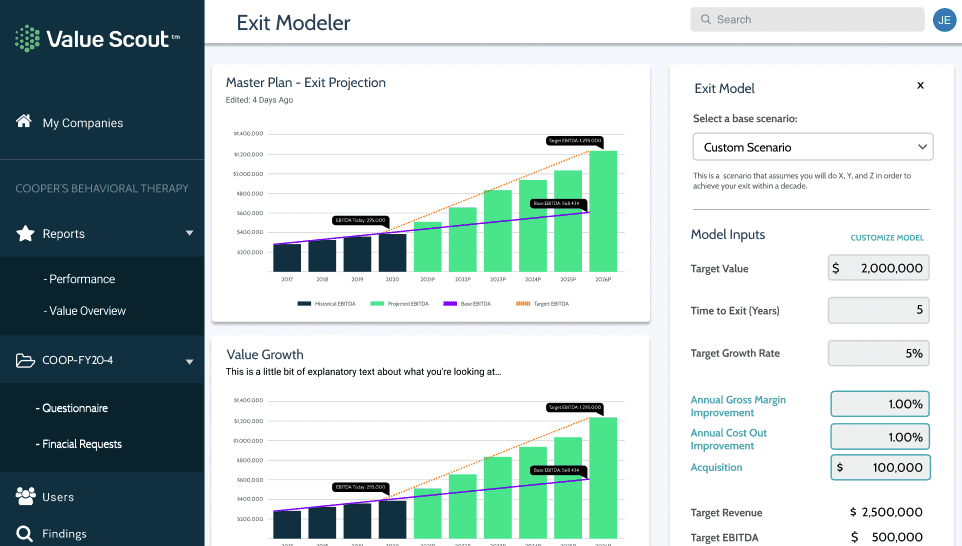

The Value Scout Exit Modeler Enables the Reality Check Conversation

Our Exit Modeler helps you define the value gap–the space between V0 and the value your client needs to retire. It shows the financial performance of past years and clearly illustrates the gap between where we are now and where we need to go. And, of course, it’s designed to facilitate the “reality check” conversation with the client. It gives us the info we need to have a complete and healthy discussion around the critical question–Is it feasible?

We need to ask them that looking at the gap between these two lines, what are we going to do to start to bend this line upwards? And as a management consultant or value creation specialist, this is your bailiwick right here, figuring out how to create that inflection point.

Either we need to convince the leadership team of the hard work it will take to move that line upward and create an inflection point in the performance or change their goals.

That’s an actual ‘reality check’ right there. We use this tool all the time to center companies and founders on the tricky question: Are their goals realistic? And if not, we have to change them.

Value Scout Guided Discovery Tools Enable the Difficult Questions Associated with the “To Be Company”

Value Scout also provides a tool for a Guided Discovery session. It is the ideation phase, where you get the founder and senior leadership in a company to come to the table and work on the ‘To Be Model’ and a long-range strategy. There is a whole process that goes into working the best practices. First of all, it’s not just handing the plan.

Second of all, just doing this with a founder is not perfect. The way to do this is to involve senior leadership and the executive staff. Ideally, we want to involve as much of the company as possible so that everyone has ownership of this process as we get into the execution phase.

Suppose you are a financial advisor working with a company, and the management has told you that they will sell in three to five years for $25 million. Working through this scenario or getting some insight into how realistic their plan is, if they have not come up with a way to create the separation and increase the value growth rate, that’s probably not a prospect for you.

That is not a company that will sell in three to five years unless they change their goals. And in our experience, the way those goals get changed is usually by extending the timeline, not by reducing the target value.

As a financial advisor or wealth manager, suppose your goal is to accumulate assets and look for that liquidity event. And they said three to five years, and with a scenario like this, that might be five to seven years.

It may not be the best prospect for you in such a case. So, a good way is to get more granular information and details on your client. Also, start scoring: Is this your next prospective client?

See Value Scout in Action

Advisors and their clients leverage Value Scout to identify their present value, articulate their desired future value, and model and implement the scenarios that will help them get there. Schedule a demo to learn more.