Survey results are in, and we have spent months going through the findings to understand the impact of 2020’s COVID-19 pandemic on value creation, revenues, exit plans, and advisor relationships. We wanted to understand the dynamics and the interaction that has happened between advisors and their clients.

We surveyed approximately 600 entrepreneurs, privately held companies in the $5 to $100 million segment. About 60 percent are in the $5 to $25 million range. We asked them whom they see as their most trusted advisors. Increasingly, business owners responded that their most trusted business advisors are those closest to their situations:

- 24 percent say their wealth manager,

- 19 percent say their lawyer, and

- Fifteen percent say their spouse.

For a lot of entrepreneurs, the pandemic was a test of their advisor relationships. Even for the most seasoned business leaders, it was a once-in-a-lifetime experience. Would their advisors help them navigate through a challenging economy or let them down? Entrepreneurs expected their advisors to be more actionable, be more technical, be more direct, be more present, be more helpful, be more proactive, be more tactical, and know their business.

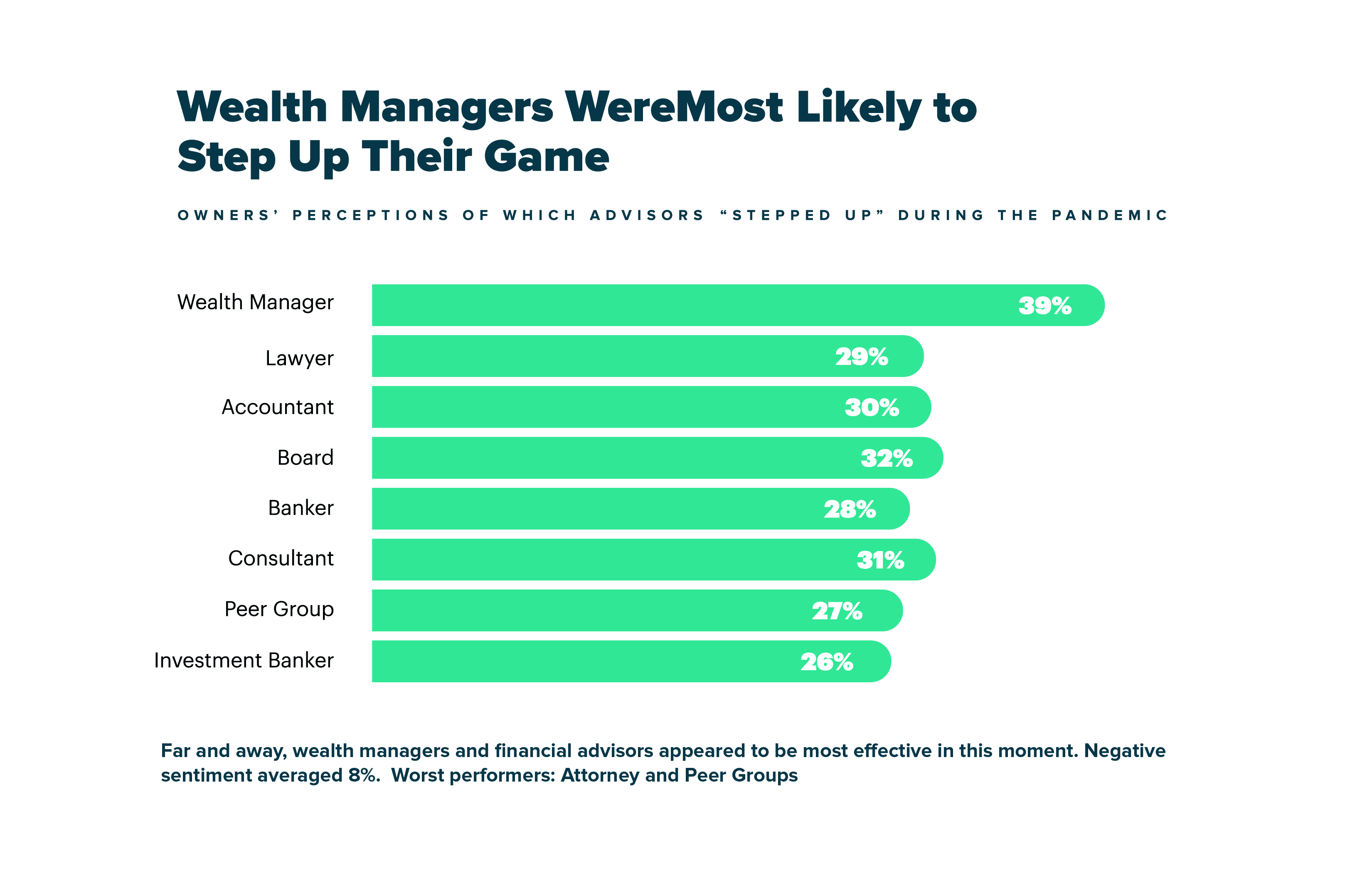

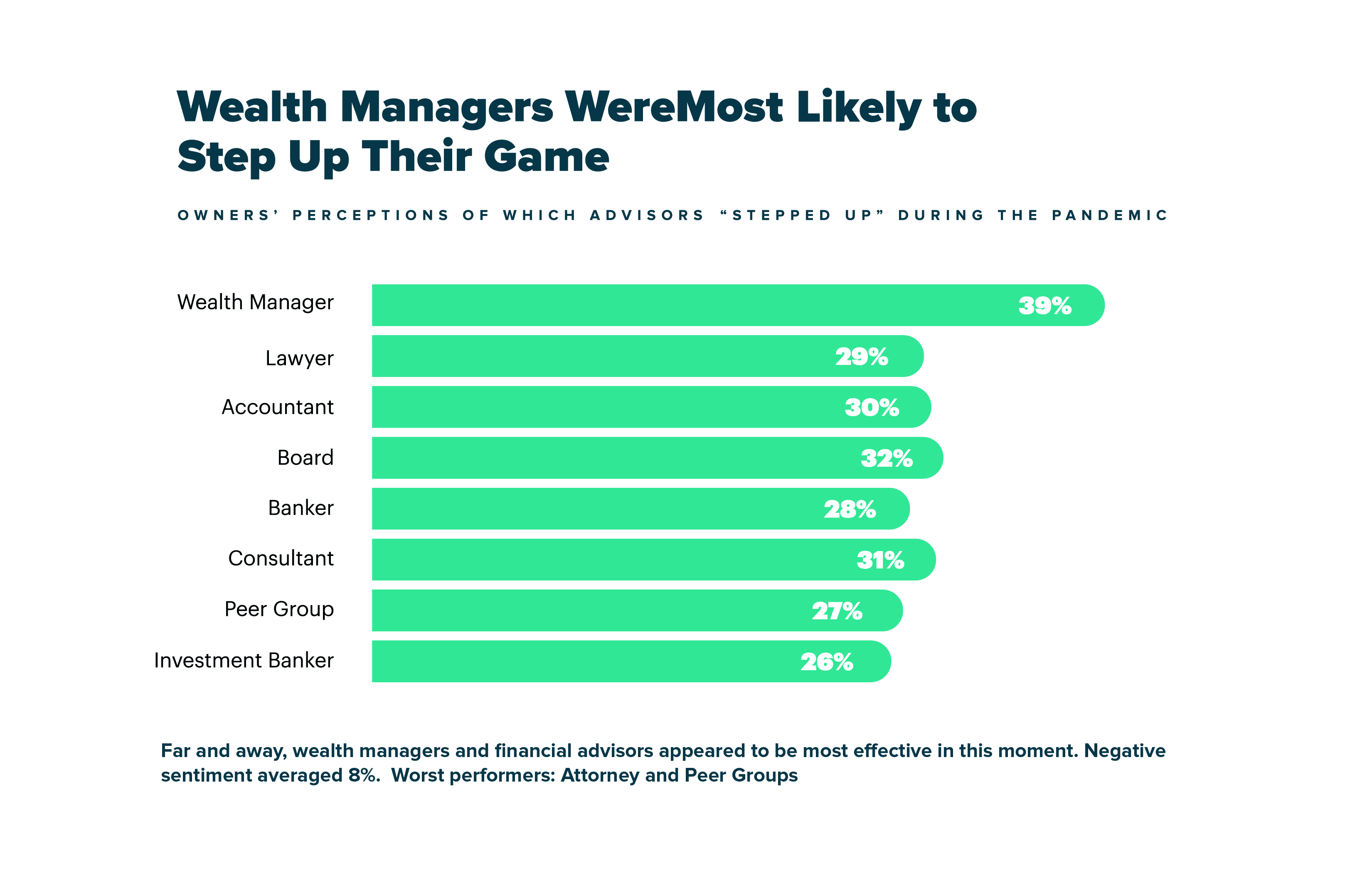

Which Advisors Stepped Up During the Pandemic?

By and large, owners said wealth managers, board members, and consultants were more likely to “step up” at this moment. They were seen as most likely to “step up” and most effective during the pandemic. They offered timely, targeted, and actionable advice. At the opposite end, bankers and peer groups were seen as the least likely to “step up.” On the whole, only 30 percent of advisors “stepped up.”

Who Joined the Group?

Nearly half of the business owners surveyed (45%) brought on new advisors during the pandemic. During times of duress, do we want to change to an accountant? Do we want to change our bank during this period or our wealth manager? Thirty percent (30%) of wealth managers were replaced, producing a barbell effect. The best-in-class wealth managers are doing well; the ones not doing well were replaced. The pandemic presented an opportunity for a new advisor to take over a relationship.

It’s not surprising to see 15 percent of banks being replaced, an action that likely stems from PPP loans, although the data does not specify. I saw many clients switch banks based on the reaction time of their particular lenders to the PPP program. Perhaps the switch was a structural, one-time occurrence unlikely to happen again. However, maybe their bankers were subject to unfavorable bank policies, or perhaps reasons arose from bankers’ performance.

Owners were most likely to bring on:

- New financial advisors (was their performance a simple halo effect? or was it real?)

- New accountants (despite the challenge of interviewing and hiring a firm, 19 percent of owners did).

If only 30 percent of advisors stepped up, what were the other 70 percent doing? Do we think 30 percent was good enough?

Did You Miss the Signals?

Did the pandemic catch you, an advisor, flat-footed? Did your clients ask you questions you simply couldn’t answer? Did you come off as tone-deaf (i.e., chaos was unfolding in many parts of the economy, but you acted as if nothing had changed) or indifferent to your clients’ challenges?

Were you surprised by which clients did well and which ones struggled? What does that tell you about how well you know your clients’ businesses? Do you know your clients’ businesses as well as you think you do?

Did you fail to notice indicators that the relationship wasn’t going well before the pandemic? Did clients cancel meetings last minute? Did they reject your advice? Did clients use the pandemic as an opportunity to look at who in their advisor network was delivering the best value and to push aside the poor performers?

Did You Miss an Opportunity?

Clients needed guidance more than ever in 2020. Did you do everything you could to provide it, even if that advice stretched your knowledge or skill set? Did you put in the extra hours? Did you make yourself available as quickly as possible? In short, did you earn your clients’ future loyalty and respect?

What Now?

An old saying: Companies don’t fail during a recession. They fail during a recovery. Even if you missed the signals or missed the opportunity, you have three quarters ahead of you to reverse course and to be the advisor your clients expect and demand that you be.

Survey findings show many business owners say that their advisory team does not know their business well enough to offer accurate advice. It’s easy to provide a platitude. Suppose the owner asks how to grow sales. Solid, actionable advice versus anodyne advice is, without a doubt, what entrepreneurs want.

So, 70 percent of advisors didn’t step up, and it just felt too much like business as usual. Survey findings also indicate a distinct lack of enthusiasm for impersonal form letters. Suppose there are 10 million different distribution lists. The once or thrice weekly update from your broker or the newsletter isn’t awesome if we, as advisors, treat our routine communique as solving problems and keeping our clients happy. The data proves otherwise. Business owners tell us they want something different: they want more than platitudes that don’t work.

Our data shows that 80 percent of owners want to focus on the highest priority–shareholder value creation going forward. They want to build a resilient business that can better weather economic and marketplace disasters. The pandemic and other market upsets are great opportunities for you, as an advisor, to focus on building more resilient organizations and driving value for individual clients. Use the opportunity to rethink how you position your practice.

Co-creation of value is a team sport. As an advisor, you have a specific skill set, the company and the CEO bring something to the market, and the team needs to create value.

So, 2020 was hugely disruptive to revenue models and enterprise value. How do we improve our performance and be more deliberate about value creation? Value Scout, as a platform, is geared towards value creation through the application of a statistical analysis system. The information helps companies correlate specific initiatives to value creation work through a robust planning process quarterly and annually. We provide this method or process as a service guiding company strategy clear to value creation. Schedule a demo here.

For more insight on the impact of the pandemic on middle-market businesses and their advisor relationships, download our e-book, 2021: Recovering Value Lost and Charting a Path Forward.