Valuation adjustments, also known as “normalization adjustments,” relate to the most common standard of value used, Fair Market Value (“FMV”), meaning – the agreed-upon price determined in a transaction between a willing buyer and willing seller, with equal knowledge of the facts, and the buyer is entirely hypothetical.

Given the definition of FMV, where the buyer is hypothetical, normalizing the financial statements is essential; a buyer is interested in the profitability or cash flow if they take over the business. Therefore, valuing a business without normalization could potentially skew the value of the business. Ultimately, this occurs because not all companies are required to follow GAAP. This means that there is potential that a company could record personal or discretionary expenses on the financial statements. Additionally, while GAAP recording is considered more reliable, it does not always reflect the economic reality of a company. This is why it is important to understand the company’s structure and history, and financials.

What do we mean by normalizing? A valuation adjustment is generally split into one of three categories; (1) an adjustment for discretionary or personal expenses; (2) an adjustment for non-recurring expenses; and (3) an adjustment for owner’s compensation.

Related: The EBITDA Myth.

Discretionary Expenses

The first category, adjustments for discretionary or personal expenses, are generally the most obvious and easiest for a valuation analyst to justify. If your first reaction after analyzing an expense on the profit and loss is: “Why is this on a business’s income statement?!?” then the adjustment is likely warranted. Some notable instances include country club dues, child support expenses, personal landscaping, and my all-time favorite: a racehorse! Let it be known; these are certainly not your everyday valuation adjustments, but it does happen!

Non-Recurring Expenses

The second category, an adjustment for a non-recurring expense, can be tricky to justify. Non-valuation professionals may argue that these expenses shouldn’t be adjusted because they are legitimate business expenses. While true, these expenses can be… expensive! And this can skew profitability and cash flow, resulting in a business being undervalued. Some examples of adjustments for non-recurring expenditures could be expenses related to moving or an increased expenditure associated with professional fees due to a company restructuring. Generally, understanding what the business does on a routine basis (relating to their operations and industry) can pinpoint if an expenditure can be classified as non-recurring (and should be adjusted) or a regular business expense (should not be adjusted).

Owner’s Compensation

The final category, an adjustment for owner’s compensation, is an owner’s salary down to a reasonable level. At face value, this makes sense: if an owner pays themselves in excess of the norm, their company’s profits and cash flow will decrease, resulting in an undervaluation. The more complicated part is defining a reasonable level that an owner should be salaried at. Several professional resources consider a firm’s size and earnings to determine an appropriate level of compensation. Also, valuation analyst can use their best judgment and experience to determine a reasonable level of owner’s compensation.

Valuation Adjustments Example – ManufacturerCo, LLC.

Below is an example of how a valuation analyst goes through the process of identifying valuation adjustments. In this example, Joe and Jane hire ValuationCo to assess the value of their company for exit planning purposes.

Company Background

ManufacturerCo, LLC., was founded ten years ago by husband-and-wife Joe and Jane Doe. The Company manufactures hand-crafted (custom ordered) wooden shelves, tables, chairs, dressers, benches, and other products requested by customers. In recent years, the Company started manufacturing designs that can be mass-produced. This accelerated the firm’s growth.

The company operates out of Pittsburgh, Pennsylvania, and leases a 4,500 square foot facility, where production, packaging, and shipping occur. The company’s hand-crafted products are only available through their website, where their mass-produced designs (i.e., standard) are featured on Wayfair, Target, and Wal-Mart. The Company is also looking to set up e-commerce through Amazon.

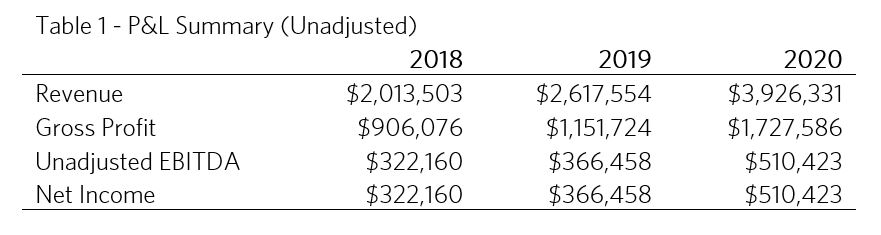

The company has grown considerably over the past three years, with revenue growing from $2M in 2018 to $3.9M in 2020 or a CAGR of approximately 25%. The Company also controlled its direct costs well; gross margins stayed relatively constant, despite the large year-over-year growth. The Company’s unadjusted earnings before interest, taxes, depreciation, and amortization grew with revenue, but margins did drop from 16% in 2018 to 12% in 2020.

See below for a summary of the Company’s performance over the past three years.

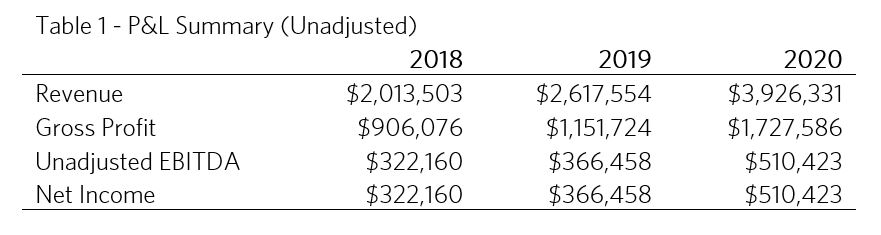

Valuation Adjustments

As the analysis on ManufacturerCo gets deeper, several expense lines stand out. In particular, the analyst immediately adjusts the following line items of the P&L: (1) owner’s auto expense; (2) owner’s 401k match; (3) discretionary meals and entertainment; (4) and employee gifts. The analyst also inquires about several expense lines that increased from the prior period; these could potentially be non-recurring expenses. Such expenses for ManufacturerCo included legal fees and security expenses. Finally, the analyst is also provided information on Joe’s salary (CEO) and decided to adjust it to market level based on his research and experience.

Joe and Jane explained that the increase in legal fees from 2019 to 2020 resulted from problems with a disgruntled employee; the Company expects 2021’s legal fees to go back to ordinary levels. The security line item appeared in 2020 for the first time. Joe and Jane explained that this was reclassified as security in 2020 (previously under “miscellaneous expense”) and that this expense should not be adjusted.

The analyst used his knowledge and experience to decide upon an approximate fair level of compensation for Joe at $150,000 per year, down from his actual salary of $200,000.

Given how valuation calculations (multiples and discount rates) function, this drastically affects value. The total adjustments for ManufacturerCo resulted in a difference of over $300K in value.

See table 2 for a visual of the valuation adjustments.

Conclusions

When performing a valuation, it is important to analyze the P&L for expenses subject to a valuation adjustment. Remember, there are three categories of valuation adjustments: (1) discretionary or personal expenses; (2) non-recurring expenses; and (3) normalizing owner’s compensation. As with our demonstration of the manufacturer, properly analyzing the P&L and performing due diligence with a client is necessary to determine if an adjustment is necessary or not. Neglecting this step can skew conclusions drastically and result in an unfavorable and incorrect conclusion for your client.